Your Obligations, Their Rights (Part 2)

There are many legal obligations, employee rights and ATO compliance to consider when deciding if a new hire is right for your business. In Part 1 of this blog, we covered New Hire & Onboarding and Payments, Payslips and Records. Part 2 will cover some basic points on Leave and End of Employment.

Again, knowledge is the first step to making the right decisions. So, do your research, understand your legal obligations and know what is required of you as an employer. There are many resources available to help you along the way. As usual, by surrounding yourself with trusted professionals, you will get the right advice to keep you on the right side of the law.

Leave

Employees can take leave for many reasons. It is important to understand what your employees are entitled to and what your rights are as an employer. Minimum leave entitlements come from the National Employment Standards (NES). An Award or registered agreement may provide other leave entitlements but they can’t be less than what is outlined in the NES.

Some comment types of leave are:

- Annual Leave – sometimes known as holiday pay.

- This is generally 4 weeks of leave accrued through the year for all employees except for casual employees (shift workers are entitled to 5weeks of Annual Leave).

- It is based on the employee’s ordinary hours of work.

- Unused leave is rolled over from year to year and any unused leave is paid out at the end of employment.

- Annual leave will continue to accrue when an employee is on any paid leave (annual or sick/carers leave), community service leave and long service leave.

- In some cases, you may be obligated to pay leave loading of 17.5% of the employee’s base rate.

- You may be able to direct employee to take annual leave in certain circumstances, like during Christmas shutdown period or if the employee has accrued more then 8 weeks of leave – this is often dependent on the Award being used.

- It’s a good idea to have a policy on how and when employees can make a request for annual leave. You can only refuse a leave request if the refusal is reasonable.

- Sick and Carer’s leave

- Full and Part-time employees are entitled to 10 days sick and carers leave (pro-rata)

- Casual employees are entitled to 2 days of unpaid carer’s leave per occasion

- Leave is accrued from the first day of employment and is rolled over from year to year. It is NOT paid out at the end of employment

- Employees can use this leave if they are sick or if they need to provide care for an immediate family or household member

- You can ask for evidence to support the leave taken, either a medical certificate or statutory declaration are generally acceptable forms of proof

- Compassionate and Bereavement Leave

- All employees are entitled to 2 days compassionate leave each time an immediate family or household member dies or suffers a life-threatening illness or injury.

- Recently, the Fair Work Act was updated to include miscarriage as a reason to access compassionate leave

- Full-time and part-time employees receive paid compassionate leave at their base rate of ordinary hours, while casual employees receive unpaid compassionate leave.

- Public Holidays

- Public Holidays may be different depending on your state or territory. It is important to know when public holidays are as employees can get different entitlements on these days

- If an employee does not work on a public holiday, they are entitled to be paid at the base rate for their ordinary hours

- Employees that work on public holidays will be entitled to holiday penalties rates or time in lieu, depending on your award or registered agreement

There are many other types of leave that employees may be entitled to (either paid or unpaid), including:

- Maternity & Parental Leave

- Family and Domestic Violence leave

- Community Service Leave (including jury duty)

- Long Service Leave

- Workers Compensation

For more information visit The Fair Work Ombudsman (Fair Work) website, they also have a handy Leave Calculator that can help you work out your employees’ entitlements.

It is also important to understand your Superannuation obligation in regards to leave – you can learn more on the ATO Website.

Ending Employment

There will come a time when someone’s employment will end. It can happen for many different reasons—an employee may resign, or they could be dismissed by you, their employer. However the employment relationship ends, it is important to follow the rules and regulations around ending employment, including notice and final pay.

There are certain obligations under the NES that must be followed. You should also check your relevant award or registered agreement, employee contract and workplace policies. Employees may also be required to follow certain obligations including giving sufficient notice (which will depend on their duration of employment).

Ending employment is a stressful time for both the employer and employee. Arming yourself with the right information will give you the confidence you are meeting all your obligations.

- Notice

- This is the length of time that you or your employee needs to give to end their employment. The length of notice will depend on how long the employment period has been.

- Employers should give notice in writing

- An employee can be paid out in lieu of notice

- If an employee does not give the required amount of notice, the payment in lieu of notice can be deducted from their final payment

- If an employee is terminated on grounds of serious misconduct, the employer does not have to provide any notice, but is obligated to pay out all other entitlements (such as payment for hours worked, unused annual leave, and where applicable long service leave)

- Final Payment

- Final pay, also known as Employee Termination Payments (ETP), is what is owed to an employee at the end of their employment

- Most awards require the ETP to be paid within 7days of the end of employment

- ETP should include (where applicable):

- Outstanding wages for hours worked

- Unused annual leave, including leave loading

- Accrued or pro-rata long service leave

- Payment in lieu of notice

- Redundancy pay

- For casual employees, each payment is considered a final pay and must include all their wages and entitlements

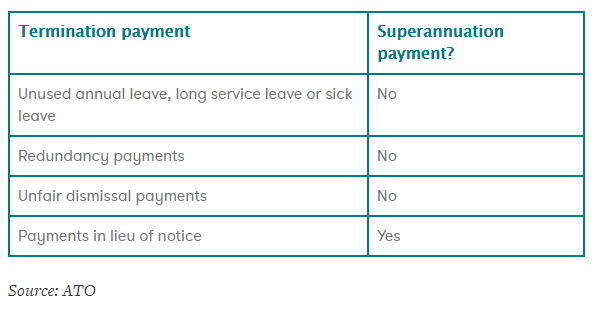

- Superannuation is not applied to all parts of ETP’s

Other things to consider at the end of employment are:

- Redundancy

- Unfair Dismissal

- Bankruptcy & Liquidation

For more information visit the Fair Work Website

Pacific Accounting

This 2-part blog has touched on some of the main areas of employment and payroll, but there is a lot more to learn and remember. And not only that—in most cases, legislation around payroll and employment is continually changing. Changes to awards, minimum wage, superannuation and more can change annually and it is your responsibility to stay up to-date.

One of the best ways to ensure you are doing the right thing is to get sound advice—a trusted bookkeeper or accountant can provide payroll accounting services. Pacific Accounting process payroll for 100’s of employees across Australia every week. We provide payroll accounting services across many industries, keeping up to date with changes in legislation to ensure you are always doing the right thing by your employees and for your business. You can book a free Virtual Chief Financial Officer (VCFO) consultation or just call us at 1800-1800-98 so we can serve you better.